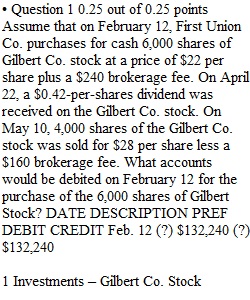

Q • Question 1 0.25 out of 0.25 points Assume that on February 12, First Union Co. purchases for cash 6,000 shares of Gilbert Co. stock at a price of $22 per share plus a $240 brokerage fee. On April 22, a $0.42-per-shares dividend was received on the Gilbert Co. stock. On May 10, 4,000 shares of the Gilbert Co. stock was sold for $28 per share less a $160 brokerage fee. What accounts would be debited on February 12 for the purchase of the 6,000 shares of Gilbert Stock? DATE DESCRIPTION PREF DEBIT CREDIT Feb. 12 (?) $132,240 (?) $132,240 • Question 2 0.25 out of 0.25 points Assume that on February 12, First Union Co. purchases for cash 6,000 shares of Gilbert Co. stock at a price of $22 per share plus a $240 brokerage fee. On April 22, a $0.42-per-shares dividend was received on the Gilbert Co. stock. On May 10, 4,000 shares of the Gilbert Co. stock was sold for $28 per share less a $160 brokerage fee. What accounts would be credited on February 12 for the purchase of the 6,000 shares of Gilbert Stock? DATE DESCRIPTION PREF DEBIT CREDIT Feb. 12 (?) $132,240 (?) $132,240 • Question 3 0.25 out of 0.25 points Assume that on February 12, First Union Co. purchases for cash 6,000 shares of Gilbert Co. stock at a price of $22 per share plus a $240 brokerage fee. On April 22, a $0.42-per-shares dividend was received on the Gilbert Co. stock. On May 10, 4,000 shares of the Gilbert Co. stock was sold for $28 per share less a $160 brokerage fee. What accounts would be debited on April 22 for the receipt of the divided on the Gilbert Co. Stock? DATE DESCRIPTION PREF DEBIT CREDIT Apr. 22 (?) $2,520 (?) $2,520 • Question 4 0.25 out of 0.25 points Assume that on February 12, First Union Co. purchases for cash 6,000 shares of Gilbert Co. stock at a price of $22 per share plus a $240 brokerage fee. On April 22, a $0.42-per-shares dividend was received on the Gilbert Co. stock. On May 10, 4,000 shares of the Gilbert Co. stock was sold for $28 per share less a $160 brokerage fee. What accounts would be credited on April 22 for the receipt of the divided on the Gilbert Co. Stock? DATE DESCRIPTION PREF DEBIT CREDIT Apr. 22 (?) $2,520 (?) $2,520 • Question 5 0.25 out of 0.25 points Assume that on February 12, First Union Co. purchases for cash 6,000 shares of Gilbert Co. stock at a price of $22 per share plus a $240 brokerage fee. On April 22, a $0.42-per-shares dividend was received on the Gilbert Co. stock. On May 10, 4,000 shares of the Gilbert Co. stock was sold for $28 per share less a $160 brokerage fee. What accounts would be debited on May 10 for the sale of the 4,000 shares of Gilbert Co. Stock? DATE DESCRIPTION PREF DEBIT CREDIT May 10 (?) $111,840 (?) $88,160 (?) 23,680

View Related Questions