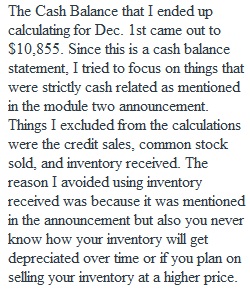

Q The goal of this discussion is to apply what you have learned while reading the chapter material and reviewing the PowerPoint presentation. Keep in mind that this discussion question will help prepare you for future exams, so it is important that you understand the information and actively participate in discussions. To supplement your learning and enhance your understanding, you may also have to conduct research outside of course provided material. Discussion Question Requirements: 1. In a minimum of a paragraph, answer the question by Thursday at 11:59 pm EST to allow sufficient time for robust peer conversation. o If the Thursday at 11:59 pm EST deadline is missed, you will still be required to complete the initial post to participate in peer discussion and earn partial credit for the assignment. 2. Pick two peers' postings and review them. Then comment in no less than one paragraph why you found the information helpful, informative, etc. You must present new ideas and/or thoughts, merely stating that you agree/disagree is not enough to earn full points. Peer postings are due no later than Sunday by 11:59 pm EST. 3. Students will not be able to see peers' postings before posting their initial post. Once you make your initial post, you are not permitted to edit. If edits are needed, you will need to reply to the original post and make the corrections there. 4. A paragraph is considered a minimum of 4-6 sentences. 5. Cite all sources - you must provide the exact link to the reference. Please keep in mind that citing sources does not mean you can copy and paste information from the source and use it as your own. You also cannot only change a few words from a source; all work must be in your own words. If copying/pasting is found or the submission is not in your own words, you will receive a zero, with no exceptions. This also includes commenting on peers' posts. Gumbo Company had the following transactions during the month of December. What was the December 1 cash balance? Transactions Transactions Dividends Paid $ 221 Credit Sales 149 Payments for equipment 1,496 Taxes Paid 2,032 Common stock sold 2,550 Inventory received 2,125 Cash sales 2,763 Cash balance Dec. 31 9,869

View Related Questions