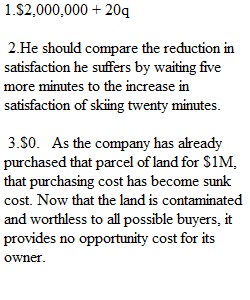

Q Question 1 1 / 1 pts You own and operate a facility located in Taiwan that manufactures microchips. At the time you purchased the facility in 2014, you paid $2 million for the land and $3 million for the plant and equipment. When you had the value of the facility recently assessed, you learned that you could sell the entire facility (including the plant, equipment and land) today for $10 million. You also know that this valuation is not going to change during the coming year. Last year you earned a return of 10% on your favorite mutual fund investments and expect the same again this year. You estimate that inputs such as energy, labor, and raw materials cost $20 per chip. Also, each year, you incur costs of $800,000 for items such as management compensation, security, legal fees, licensing fees, etc. Finally, you pay yourself $100,000 as CEO, but you estimate that you could earn $200,000 if you sold your business and took a management job somewhere else. Letting "q" denote the number of chips produced per year, what are your total economic costs of production for the coming year, taking into account all of the relevant opportunity costs that you face? Question 2 1 / 1 pts Stephen is on a skiing holiday and woke early to hit the slopes. He has been standing in the liftline for twenty minutes, waiting to get on the chairlift for his first time skiing at the ski resort. He paid $30.00 for a (nonrefundable) lift ticket which is good for the entire day. The weather is getting bad, but if he waits five more minutes he will definitely get on the chairlift and be able to ski for twenty minutes. According to the principles of sunk cost and opportunity cost decision-making, and assuming no other considerations affect his decision, which of the following statements best describes the rationale he should use to decide whether it is worth waiting the extra five minutes? Question 3 1 / 1 pts The Nifty Gum Co. has purchased a large parcel of land for $1 million. The company recently discovered that the land is contaminated and is worthless to all possible buyers. The opportunity cost of the land is: Question 4 1 / 1 pts Which of the following statements is NOT true?

View Related Questions