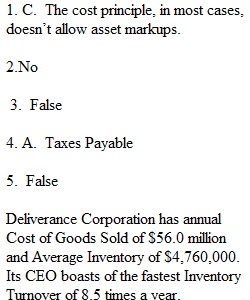

Q • Question 1 0.4 out of 0.4 points Winston Land and Cattle Company is a large operator of cattle feedlots and steak restaurants. Its recent financial statements showed their real estate holdings to be in excess of $50.0 million. Winston recently had a company-wide appraisal done for insurance purposes, and the report showed real estate to have a current market value of $356.0 million. Jim Winston, the owner, requested that the firm’s auditors show that value on the financial statements, and the auditors declined his request because: • Question 2 0.4 out of 0.4 points Deliverance Corporation has annual Cost of Goods Sold of $56.0 million and Average Inventory of $4,760,000. Its CEO boasts of the fastest Inventory Turnover of 8.5 times a year. Is he right? Selected Answer: No Answers: Yes No Response Feedback: Source: Week 2 Course Material Explanation: Inventory DOH = COGS / Average Inventory 56,000,000 / 4,760,000 11.76 turns • Question 3 0.4 out of 0.4 points Deliverance Corporation has annual credit sales of $56.0 million. Its CEO boasts of the fastest receivables turnover in the industry because he never has more than 36 days of sales in receivables. Is he correct, if receivables at the end of last quarter were approximately $8.0 million? Hint: Compute the dollar amount of daily sales. • Question 4 0.4 out of 0.4 points Which of the following is a liability? • Question 5 0.4 out of 0.4 points Top Rated Cars is a worldwide manufacturer of cars and trucks. They maintain a reserve on the balance sheet for future warranty claims. The balance in this account at December 31, 2015, 2016, 2017, and 2018 (in millions) was: $315.0, $329.0, $354.7 and $361.9 respectively. In addition, revenues for the same periods were (in millions): $10,000.8, $10,122.0, $10,098.6 and $9,999.6. From this data, one could surmise that the quality of their cars and trucks is improving.

View Related Questions