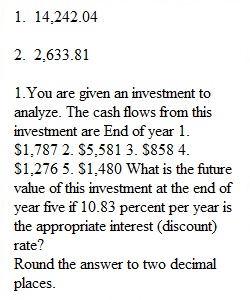

Q 1.You are given an investment to analyze. The cash flows from this investment are End of year 1. $1,787 2. $5,581 3. $858 4. $1,276 5. $1,480 What is the future value of this investment at the end of year five if 10.83 percent per year is the appropriate interest (discount) rate? Round the answer to two decimal places. 2.You have just purchased an investment that generates the cash flows shown below for the next four years. You are able reinvest these cash flows at 6.83 percent, compounded annually. How much is this investment worth at the end of year four? End of year 1. $406 2. $1,098 3. $552 4. $296 Round the answer to two decimal places. 3.You have been offered the opportunity to invest in a project that will pay $5,780 per year at the end of years one through three and $9,882 per year at the end of years four and five. These cash flows will be placed in a saving account that pays 14.31 percent per year. What is the future value of this cash flow pattern at the end of year five? Round the answer to two decimal places.

View Related Questions