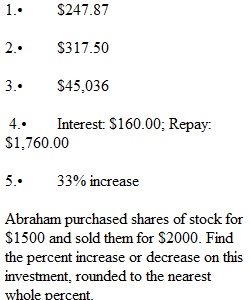

Q Question 1. Version 1*/1. Score: 1/1 Trey opens a savings account, with the goal of saving $50,000 by making deposits each month for the next 15 years. If the account pays 1.5% interest, how much should Trey deposit each month? Question 2. Version 1*/1. Score: 0/1 In answering this question, refer to the following tax bracket information for 2020. Tax Rates Rate Single Married Filing Jointly 10% $0 - $9,875 $0 - $19,750 12% $9,875 - $40,125 $19,750 - $80,250 22% $40,125 - $85,525 $80,250 - $171,050 24% $85,525 - $163,300 $171,050 - $326,600 32% $163,300 - $207,350 $326,600 - $414,700 35% $207,350 - $518,400 $414,700 - $622,050 37% $518,400 or more $622,050 or more Sean is filing taxes as an individual. In 2020, his taxable income was $9,875. If Sean had taken the opportunity to work overtime in 2020 to ean an additional $1000, how much additional income tax would he owe? Question 3. Version 1*/1. Score: 1/1 The Davises are a married couple who file their taxes jointly. In 2020, they had a combined adjusted gross income of $89,750. • Their itemized deductions are: o $13,528 for charitable contributions o $15,542 for mortgage interest o $15,644 for educational expenses • In 2020, the standard deduction for a married couple filing jointly was $24,800. What was the Davises' taxable income for 2020? Question 4. Version 3*/3. Score: 0/1Expand Kendrick borrows $1600 for two months at 6% simple interest. Find the amount of interest paid and the amount that Kendrick must pay back at the end of two months. If necessary, round to two decimal places. Question 5. Version 1*/1. Score: 1/1 Abraham purchased shares of stock for $1500 and sold them for $2000. Find the percent increase or decrease on this investment, rounded to the nearest whole percent.

View Related Questions