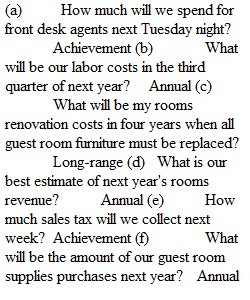

Q Budgeting & Internal Controls #1Worksheet MGT 225 - Managerial Accounting 1. Identify the specific type of budget that would best address each of the following questions a full?service hotel manager would like to answer. (Test Your Skills 1) • Long?range • Annual • Achievement ?Question Type of Budget (a) ?How much will we spend for front desk agents next Tuesday night? (b) ?What will be our labor costs in the third quarter of next year? (c) What will be my rooms renovation costs in four years when all guest room furniture must be replaced? (d) ?What is our best estimate of next year's rooms revenue? (e) ?How much sales tax will we collect next week? (f) ?What will be the amount of our guest room supplies purchases next year? (g) ?How many guest rooms will we sell next year? (h) ?How many guest rooms will we sell next week? (i) ?What will be the cost of replacing the hotel's HVAC (heating/ventilation and air conditioning) system five years from now? (j) ?What is our best estimate of next year's food and beverage revenue? 2. Zheng Chung is the managing owner of the Stillwater Grill. Last year was good year for him. Now he is preparing his budget for next year. Using the information that Zheng believes will be true, help him complete the dollar and percentage amounts in the budget worksheet that follows and then answer the questions he has about next year. Based upon his sales histories, sales projections, and cost records, Zheng predicts that next year his operation will experience. (Test your Skills 3) ?Increase in food sales 6% ?Increase in beverage sales 4% ?Change in food and beverage cost % 0% ?Increase in management and staff costs 3.5% ?Increase in employee benefits 10% ?Increase in all other controllable expenses (except depreciation) 2% ?Monthly depreciation $750 ?Monthly interest payments $1100 ?Tax rate assessed on income before income taxes 25% The Stillwater Grill Budget Worksheet for Next Year Last Year Actual ($) % Next Year Budget ($) % ?SALES ?Food ?346,500 ?Beverage ?113,500 ? Total Sales ?COST OF SALES ?Food ?116,500 ?123,409 ?Beverages ?18,750 ?19,477 ? Total Cost of Sales ?LABOR ?Management ?30,500 ?Staff ?42,000 ?Employee Benefits ? Total Labor ?84,900 ?PRIME COST ?OTHER CONTROLLABLE EXPENSES ?Direct Operating Expenses ?16,550 ?Music and Entertainment ?3,200 ?Marketing ?6,650 ?Utilities ?11,950 ?Administrative and General Expenses ?12,750 ?Repairs and Maintenance ?3,500 ? Total Other Controllable Expenses ?CONTROLLABLE INCOME ?NON?CONTROLLABLE EXPENSES ?Occupancy Costs ?30,000 ?30,000 ?Equipment Leases ?0 ?0 ?Depreciation and Amortization ?8,400 ?Total Non?Controllable Expenses ?RESTAURANT OPERATING INCOME ?Interest Expense ?14,000 ?INCOME BEFORE INCOME TAXES ?Income Taxes ?33,213 ?NET INCOME 1. What will be Zheng's total sales next year? 2. What will be Zheng's total cost of sales next year? 3. What will be the amount Zheng will spend on management, staff, and employee benefits next year? 4. What is the estimated amount of income taxes Zheng will pay next year? 5. What does Zheng estimate will be his operation's net income percentage (profit margin) next year? How will that compare to last year's percentage?

View Related Questions