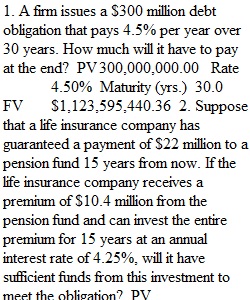

1. A firm issues a $300 million debt obligation that pays 4.5% per year over 30 years. How much will it have to pay at the end? PV 300,000,000.00 Rate 4.50% Maturity (yrs.) 30.0 FV $1,123,595,440.36 2. Suppose that a life insurance company has guaranteed a payment of $22 million to a pension fund 15 years from now. If the life insurance company receives a premium of $10.4 million from the pension fund and can invest the entire premium for 15 years at an annual interest rate of 4.25%, will it have sufficient funds from this investment to meet the obligation? PV 10,400,000.00 Rate 4.25% Maturity (yrs.) 15.0 FV 22,000,000.00 Amount required $19,416,649.63 Over/(Under) (2,583,350.37)1. A firm issues a $300 million debt obligation that pays 4.5% per year over 30 years. How much will it have to pay at the end? PV 300,000,000.00 Rate 4.50% Maturity (yrs.) 30.0 FV $1,123,595,440.36 2. Suppose that a life insurance company has guaranteed a payment of $22 million to a pension fund 15 years from now. If the life insurance company receives a premium of $10.4 million from the pension fund and can invest the entire premium for 15 years at an annual interest rate of 4.25%, will it have sufficient funds from this investment to meet the obligation? PV 10,400,000.00 Rate 4.25% Maturity (yrs.) 15.0 FV 22,000,000.00 Amount required $19,416,649.63 Over/(Under) (2,583,350.37)